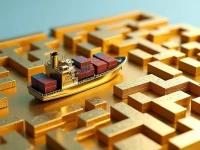

Key Strategies for Optimizing Heavy Cargo Air Freight

Priority for loading heavy cargo in international air freight is determined by pallet position load capacity, aircraft characteristics, and cargo density, not solely by weight. Understanding weight distribution principles helps shippers avoid delays and improve loading rights during peak season. The core standard is cargo density, supplemented by destination concentration and aircraft compatibility. Balancing safety and efficiency requires adhering to principles of even weight distribution, centered gravity, and aircraft suitability. Optimizing cargo information, selecting standard packaging, and signing priority agreements can enhance loading priority.